AlpineRemote® Services: Deposit & Online Payment

AlpineRemote® Deposit enables your business to quickly and securely process paper check payments from your desk using one of our check scanners.

Need Help with AlpineRemote Deposit?

{beginAccordion}

Getting Started

First Time Logging in to AlpineRemote Services:

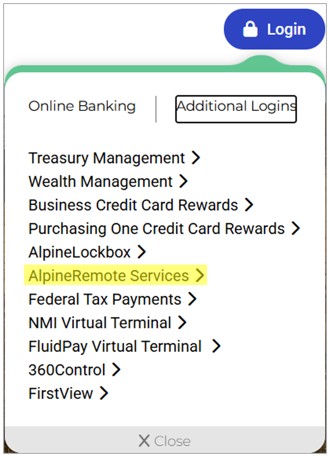

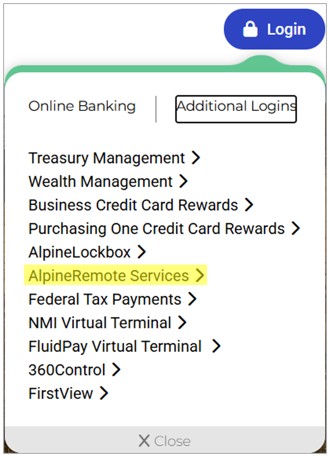

- From the top of any alpinebank.com page, click on Logins, then click on AlpineRemote Services (located under Additional Logins)

- Login with your user credentials provided by your Commercial Banker.

- Once logged in, you will be prompted to create a new password and a security question.

Password requirements: At least one uppercase letter, at least one lowercase letter, at least one number and at least one special character (e.g., !@#$%). Password must be a minimum of 12 characters in length and cannot be username.

Install Check Scanner Software

Please see the following guide: Scanner Installation User Guide

Please Note: Administrative rights will be required in order to install the scanner software on the PC.

System Requirements:

Windows 11: Microsoft Edge or Google Chrome.

.NET Framework 4.8 or higher

USER MANUALS

Remote Depositing:

AlpineRemote Deposit User Guide (Quick Guide)

Getting Started Online

Scanner Installation

Epson Scanner User Guide

Add a New User

Reports

Manage Your Deposits

Deposit Results Report

Panini Troubleshooting Guide (Black lines on check images)

FAQ - Remote Check Depositing

Can the check scanner work on a different computer?

No. Scanner-specific drivers must be installed on each computer in which the scanner will be used. If the scanner is moved, or computers are changed, drivers must be installed before the scanner will work.

Do I need to clean the check scanner?

Yes. Scanner maintenance is critical for successful scanning. The maintenance includes cleaning the rollers, camera, and changing the ink cartridge when needed. Please contact your Alpine Bank eBanking Specialist for assistance and/or supplies.

How do I send a remote deposit?

For step-by-step instructions, please see the AlpineRemote Deposit User Guide.

When are the cutoff times to send a deposit for processing?

Remote deposit files are submitted for processing on business days, excluding federal holidays, based on the following cutoff times: 8:00 a.m., 10:00 a.m., 12:00 p.m., 2:00 p.m. 4:00 p.m. and 6:00 p.m. Mountain Time. Remote Deposits sent after 6:00 p.m. (MT), or on weekends, or federal holidays, are submitted for processing on the next cutoff time at 8:00 a.m. the following business day.

Can I deposit a foreign check, or a counter check?

No. Foreign checks and/or counter checks may not be remotely scanned for deposit. These checks will reject and will not post to the account.

What Do I Do With Checks After Scanning Them For Deposit?

Physical checks must be stored for a period of 30 days in a secure, preferably locked, location until they are destroyed.

You may verify the status of a check deposit by logging into the AlpineRemote Merchant Portal and reviewing the Deposit Results Report:

- Click on the Reports tab, and select the ‘Deposit Results’ link

- Select the date range, then click ‘Get Deposits’

- Check the Deposit Status column for deposit details

What are the most common Deposit Status types?

Deposited – The deposit has gone through the keying and balancing process and is in approved status until the next scheduled file cutoff time.

Open – The batch is still open to scan checks and must be closed for the deposit to be submitted.

Deleted – The user deleted the batch before it was submitted. The batch will not process and must be rescanned again into a new batch.

Rejected – the system has rejected a deposit (ex. file did not balance, or a check was scanned twice).

Tip: Compare Your Count and Your Amount against Received Count and Received Amount. You must rescan the deposit with the correct check count, and the correct total deposit amount. In the example below, Your Amount was off was off by $0.05 from the Received Amount.

{endAccordion}

AlpineRemote® Online Payment makes it possible for your business to securely accept e-checks and card payments or donations online. We create a URL that will take customers to your customized, branded payment portal. Use the URL link on your website or email it directly to your customers.

Need Help with AlpineRemote Online Payment?

{beginAccordion}

Getting Started

First Time Logging in to AlpineRemote Services:

- From the top of any alpinebank.com page, click on Logins, then click on AlpineRemote Services (located under Additional Logins)

- Login with your user credentials provided by your Commercial Banker.

- Once logged in, you will be prompted to create a new password and a security question.

Password requirements: At least one uppercase letter, at least one lowercase letter, at least one number and at least one special character (e.g., !@#$%). Password must be a minimum of 12 characters in length and cannot be your your username.

System Requirements:

Windows 11: Microsoft Edge or Google Chrome.

.NET Framework 4.8 or higher

USER MANUALS

Add a New User

Reports

SmartPay Handbook

Online Payment User Guide - Merchant

Online Payment User Guide - End User

FAQ - Online Payment

When will I receive my deposit?

The Online Payment file is submitted for processing the next business day. Everything that is submitted before 6 p.m. Mountain Time will go with the 6 p.m. file and will be deposited into your account the following business day, with our 8 a.m. file. For anything submitted after 6 p.m., your deposit will be pulled with the next day’s 6 p.m. file and will be processed the following business day, at 8 a.m. Mountain Time.

Can I void a transaction that was submitted incorrectly?

Yes, you can void any transaction that was submitted that same day.

Can I process a refund?

If you are enabled for Credit Cards, you may process a refund through the payment portal. If you only accept ACH, you will need to issue your customer a check for their refund.

What do the Dashboard terms Approved, and Processed, mean?

The status Approved means the transaction was submitted, and it's ready to go with our 6 p.m. file for processing. Any transaction that has the Approved status may be voided if necessary.

The status Processed means the transaction was processed and will be in your account with our 8 a.m. file on the next business day.

My end user can't log in with their login credentials, how can I get them get logged in?

For step-by-step instructions, please see AlpineRemote Online Payment - Merchant User Guide.

Can we add credit cards to our current online payment portal?

Yes, please contact your local branch to complete a Merchant Processing Agreement. Additional charges apply when adding credit cards.

Can we make edits to our branded online payment portal?

Yes, please contact your local branch to request additional edits and updates.

Can my end users set up, edit and/or disable Recurring and Scheduled Payments?

For step-by-step instructions, please see the AlpineRemote Online Payment - End User Guide.

{endAccordion}